The debate over the customer education organizational structure has raged in SaaS boardrooms for years, and in 2026, it’s more critical than ever. After 13+ years as CEO at Check N Click and countless hours building training systems for Fortune 500 companies, I’ve seen this question create more friction than a poorly designed onboarding flow.

Here’s the thing: there’s no one-size-fits-all answer. But there are five proven models that work: each with distinct advantages, challenges, and ideal scenarios. Let’s break them down.

The Million-Dollar Question Nobody Wants to Answer about Customer Education

“Where should Customer Education live?”

Should it roll up under Customer Success? Professional Services? Marketing? Product? Or should it stand alone as its own independent function?

I’ve sat through dozens of org chart debates where VPs defend their turf, finance questions the ROI, and the CE team just wants clarity so they can actually do their jobs. (We see you!)

Based on TSIA/CEDA research and over 1,000 hours of custom content developed for global SaaS leaders, here’s what actually works in 2026.

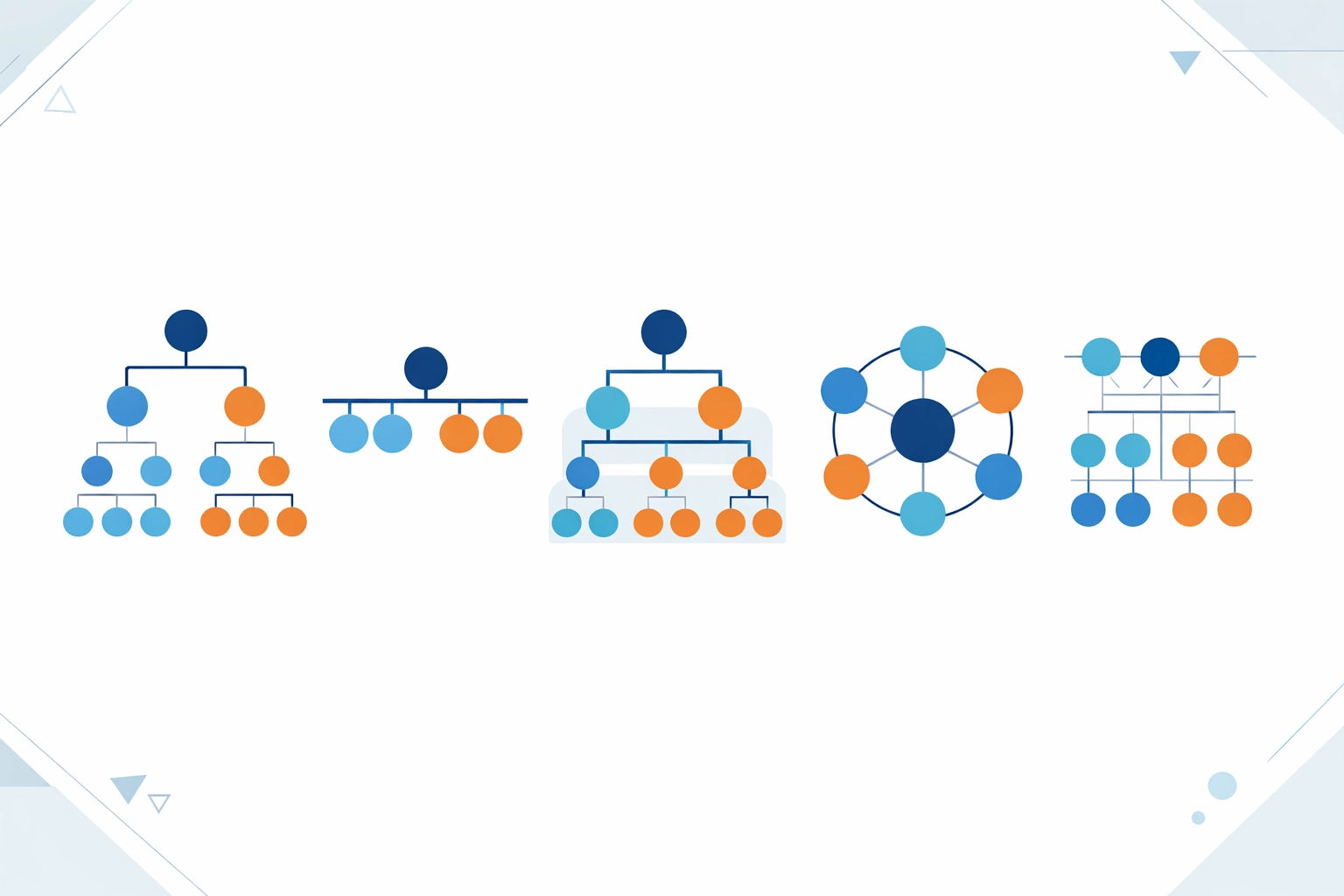

Model 1: The Customer Success (CS) Model: The Adoption Engine with Customer Education

Reporting Structure: Customer Education reports to the VP of Customer Success

Primary Goal: Churn reduction and product adoption

SME Angle: Fragmented (SMEs often pulled into reactive escalations)

This is the classic setup, and for good reason. When education lives inside Customer Success, it’s laser-focused on keeping customers healthy, engaged, and renewing. Your training isn’t just a nice-to-have: it’s directly tied to retention metrics.

The Upside:

- Direct line of sight to customer health scores

- Easy alignment with CSM workflows

- Training gaps surface quickly through support tickets

The Reality Check:

SME access can be chaotic. Product experts are constantly firefighting customer issues, so your instructional designers often have to wait in line for technical reviews. The result? Slower content development and reactive (rather than proactive) training.

Best For: Early-stage SaaS companies focused on proving product-market fit and reducing early churn.

Model 2: The PS Model: The Premium Route for Customer Education

Reporting Structure: Customer Education reports to Professional Services

Primary Goal: Revenue generation through billable training

SME Angle: THE EASIEST (training tied to billable hours ensures SME availability)

Here’s where education becomes a profit center, not a cost center. When CE lives in Professional Services, every course, certification, and workshop can be monetized. It’s not uncommon to see PS-led education programs generate seven figures annually.

The Upside:

- SMEs are contractually available for technical deep-dives

- Premium pricing justifies high-quality, complex content

- Training becomes a consulting differentiator

The Reality Check:

This model can create friction with free or low-cost customer onboarding. If your Customer Education (CE) team is focused on premium deliverables, who’s building the foundational “how to log in” content?

Best For: Complex enterprise SaaS with high ACV and customers who expect (and pay for) white-glove training.

Model 3: The Growth Model: Using Customer Education as the Acquisition Magnet

Reporting Structure: Customer Education reports to the VP of Marketing

Primary Goal: Lead generation, product-led growth, and adoption

SME Angle: Hybrid of CS + PS (reactive + strategic)

This one’s a powerhouse that often gets overlooked. When education sits in Marketing, it’s not just about retaining customers: it’s about attracting them. Think free certification programs, thought leadership academies, and gated premium content that converts prospects into buyers.

As Vicky Kennedy pointed out in the LinkedIn conversation, this is the Growth Model: education becomes a magnet, not just a safety net.

The Upside:

- Top-of-funnel impact: prospects see your education as a trust signal

- SEO and content marketing integration

- Directly measurable impact on pipeline and MQLs

The Reality Check:

Marketing-led CE can sometimes feel disconnected from post-sale customer needs. If your academy is optimized for lead gen but doesn’t help customers succeed, you’ll see high acquisition but terrible retention.

Best For: Product-led growth (PLG) companies, developer tools, and platforms with strong community motion.

Model 4: The Product Model: The SME Paradise (With a Catch) for Customer Education

Reporting Structure: Customer Education reports to the VPs of Products

Primary Goal: Product adoption and feature release support

SME Angle: GOLD STANDARD (direct access to PMs, engineers, and product roadmaps)

This model is gaining traction in 2026, especially in orgs with complex multi-product suites. When CE partners directly with Product Management, you get unfiltered access to the people building the features you’re training on.

Tony Leeming raised this model in the LinkedIn thread, and he’s right to highlight both sides of the coin.

The Upside:

- SME access is seamless (PMs and devs are your team)

- Content updates align perfectly with release cycles

- Education becomes a natural extension of product development

The Reality Check:

You risk getting too far from the customer. Product teams think in features and functionality. Customers think in terms of problems and outcomes. If your Customer Education team becomes an internal documentation factory, you’ll lose the customer empathy that makes training actually useful.

For this model to succeed, you need proactive CE professionals who track VPs and PMs for customer insights: plus product leadership that sees education as an asset, not an afterthought.

Best For: Multi-product SaaS orgs with strong product-led culture and frequent release cycles.

Model 5: The Independent Model of Customer Education: The Center of Excellence

Reporting Structure: Customer Education reports to the CEO or the COO

Primary Goal: Cross-functional impact (Sales, CS, Product, Marketing)

SME Angle: Requires “influence without authority” and structured SLA agreements

This is the holy grail for scaling Customer Education for global SaaS companies. An independent Center of Excellence (CoE) acts as a shared service across the entire org. Sales needs partner enablement? CE owns it. Does marketing need a certification program? CE builds it. Product needs release training? CE scales it.

The Upside:

- Strategic influence across every revenue-impacting function

- Centralized quality control and learning standards

- Budget and roadmap autonomy

The Reality Check:

This model only works if you have executive buy-in and structured agreements with every function. Without clear SLAs, you’ll spend half your time negotiating priorities and the other half justifying your existence.

As Roopak Krishnaswamy noted, the Independent Model truly shines when you’re scaling globally. Regional nuance: localized content, cultural adaptation, time zone-friendly delivery: becomes manageable only when you have a CoE that balances global standards with local flexibility.

Best For: Scaling global SaaS companies with $50M+ ARR and distributed teams.

The Unicorn Factor: Why Org Structure Isn’t Your Only Problem

Let’s be real: no matter where education lives, you need the right people. Scaling customer education in 2026 requires a rare blend of:

- Pure Instructional Designers (learning science, pedagogy, assessment design)

- Technical IDs (SaaS domain experts who can translate complex APIs, workflows, and integrations)

Finding those “unicorns” who can do both? That’s the real bottleneck. I’ve interviewed hundreds of candidates over the years, and maybe 10% have the technical chops and the instructional design rigor.

This is why many companies partner with specialists like Check N Click: we’ve spent 13+ years building that unicorn bench so you don’t have to.

Lessons From the Trenches: My BMC Software Experience

Back when I worked at BMC Software, we operated in a hybrid CoE-Product model. We had multiple products, strong functional leadership, and Product Managers who (thankfully) saw education as a strategic asset.

But here’s what made it work: proactive Customer Education professionals who didn’t wait for insights to come to them.

I spent months tailing VPs, sitting in on customer QBRs, listening to support calls, and lurking in communication channels. That’s where the real curriculum requirements lived: not in the product specs.

The takeaway? Whatever customer education organizational structure you choose, it only works if your CE team has the freedom (and the grit) to chase customer insights wherever they hide.

The Verdict: Matching Model to Stage

So, where should Customer Education live in your org? Here’s the cheat sheet:

Early-Stage SaaS (Seed to Series A):

→ Start in Customer Success. Focus on adoption, retention, and learning from early customer feedback loops.

Complex Enterprise SaaS (High ACV, Long Sales Cycles):

→ Lean into Professional Services. Monetize your expertise and ensure premium training matches premium pricing.

Product-Led Growth (Developer Tools, Freemium Models):

→ Embed in Marketing (Growth Model). Make education your top-of-funnel magnet and community-building engine.

Multi-Product Platforms (Frequent Releases, Complex Features):

→ Try the Product Model: but only if you have proactive CE pros who won’t lose sight of the customer.

Scaling Global SaaS ($50M+ ARR, Distributed Teams):

→ Build an Independent CoE. Centralize standards, localize delivery, and influence across every function.

Your Move

The debate over the customer education organizational structure isn’t going away in 2026. But now you have a framework to guide the conversation.

Still not sure which model fits your stage and goals? We’ve helped dozens of SaaS companies architect their CE function: from scratch to scale. Check out our Customer Education and Instructional Design services or explore why generic training programs fail before you commit to the wrong structure.

Where does education live in your organization? Drop me a message on LinkedIn or book a call with me: I’d love to hear what’s working (or not working) for your team.